E-File Income Tax Return -Web Online CA

E-filing refers to the process of electronically submitting tax returns to the government. Businesses can take advantage of several benefits, including its simplicity, precision, and rapid processing times. Many companies can now E-File Income Tax Return electronically, but not all.

How to Proceed

Businesses can easily and quickly file their income taxes online. Companies can electronically submit their income tax return file and get many benefits by adhering to the steps outlined below. From registering for e-filing to submitting tax returns, the steps for filing business income taxes electronically are summarized here.

Get the right information.

Before a business can begin the e file income tax process, it must gather the appropriate information, such as tax identification numbers, income statements, and deductions.

Select a reliable online filing service

Businesses that file their taxes electronically should use a reputable service. Before settling on an e-filing service provider, companies should compare their price, functionality, and customer feedback offerings.

Register with the e-filing service

After selecting an e-filing service provider, a business must sign up for an account with that business.

Information to be entered into the e-filing program

Following registration, businesses must use the e-filing system to report their tax information. The program will prompt users to enter the correct information appropriately during the process.

Verify and double-check for mistakes!

Before submitting a return, businesses should double-check all the details to ensure they are correct. Tools for catching errors and missing information could be built into the e-filing program.

Submit the return

After the file itr online has been checked for errors and completeness, it can be electronically filed. The computer program will verify the submission and issue a tracking number.

Pay any taxes due

The e-filing service accepts payments made by credit card, debit card, or electronic funds transfer from businesses.

Seek verification and progress reports

The e-filing service provider will then send a confirmation of receipt to the company after the return has been submitted. They can also use the Internet to track their tax return's status and see whether it has been processed, rejected, or has outstanding issues.

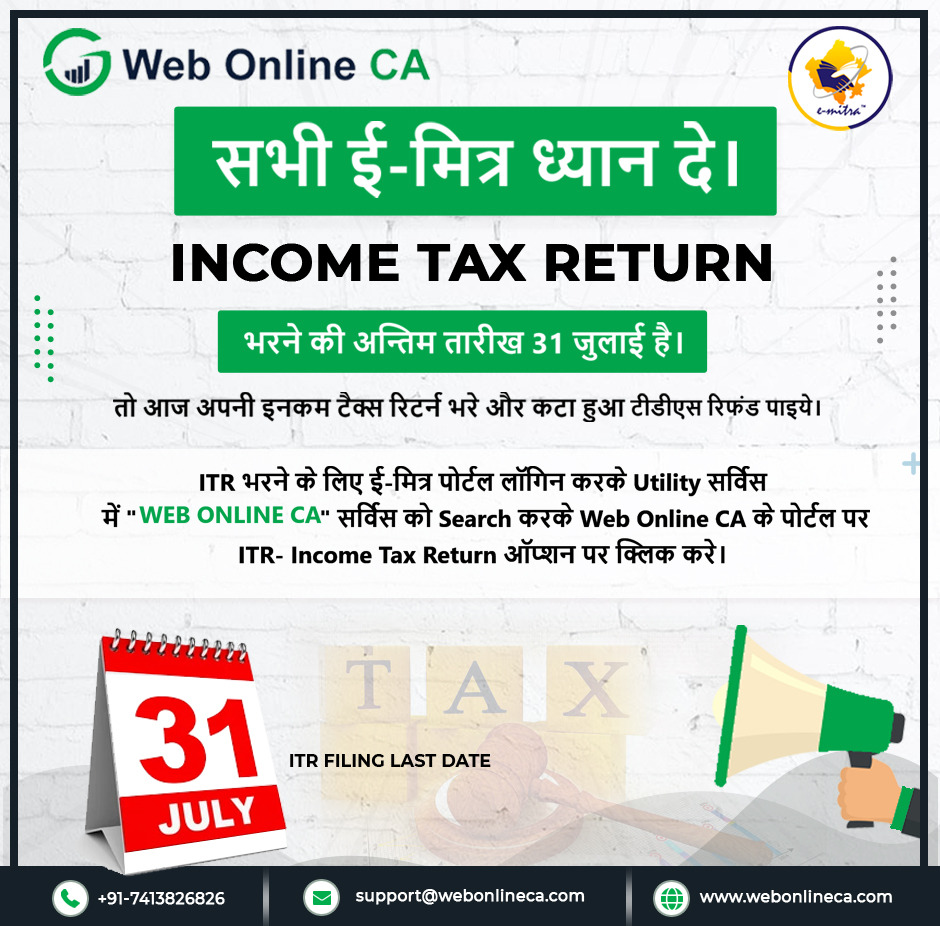

Please check these on income tax e filing website and pay close attention to the income tax itr filing due date.

Validation Documents

- For online filing by firms, an employer identification number (EIN) or similar tax identifier is required.

- Organizations should gather any previous year's financial documents pertaining to taxes, including W-2s, 1099s, and other similar documents.

- Businesses should compile all relevant documentation, such as invoices, expense reports, and receipts, to account for deductions.

- Financial statements, such as a balance sheet and income statement, should be ready if the company is required to produce them.

- Businesses should review their prior year's tax returns to ensure correctness and consistency.

Please search online itr filing near me, it provides you more details about it.

Conclusion:

Finally, for enterprises in India, electronic filing of income tax returns is essential for meeting legal requirements. By following simple instructions, businesses can e-file their income tax returns on time while also benefiting from the many advantages of e-filing. Please know more about how to file income tax return online, it makes you more conscious about itr online filing.